The Intercontinental Exchange’s (ICE) cryptocurrency project Bakkt celebrated New Year’s Eve with the announcement of a $182.5 million equity round from a slew of notable institutional investors. ICE, the operator of several global exchanges, including the New York Stock Exchange, established Bakkt to build a trading platform that enables consumers and institutions to buy, sell, store and spend digital assets.

This is Bakkt’s first institutional funding round; it was not a token sale. Participating in the round are Horizons Ventures, Microsoft’s venture capital arm (M12), Pantera Capital, Naspers’ fintech arm (PayU), Protocol Ventures, Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Goldfinch Partners and more.

Bakkt is currently seeking regulatory approval to launch a one-day physically delivered Bitcoin futures contract along with physical warehousing. The startup initially planned for a November 2018 launch, but confirmed this morning an earlier CoinDesk report that it was delaying the launch to “early 2019” as it awaits permission from the Commodity Futures Trading Commission. Along with the funding, crypto news blog The Block Crypto also reports Bakkt has hired Balaji Devarasetty, a former vice president at Vantiv, as its head technology.

ICE’s crypto project was first announced in August and is led by chief executive officer Kelly Loeffler, ICE’s long-time chief communications and marketing officer. Bakkt quickly inked partnerships with Microsoft, which provides cloud infrastructure to the service, and Starbucks, to develop “practical, trusted and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks,” Starbucks vice president of payments Maria Smith said in a statement at the time.

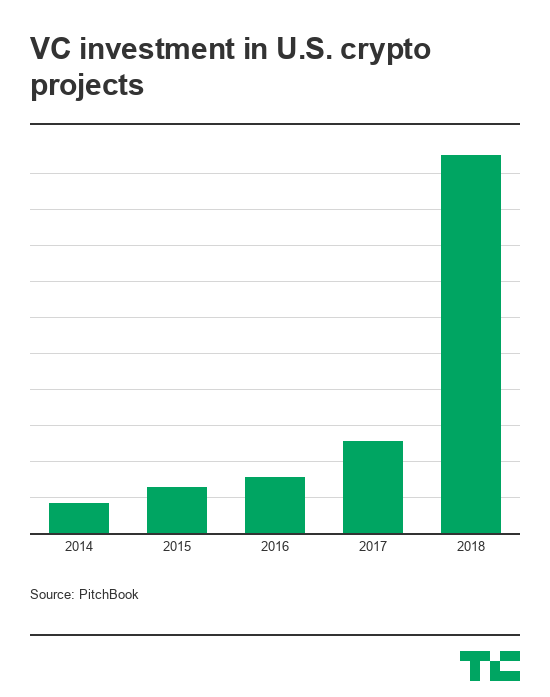

Many Bitcoin startups floundered in 2018, despite record amounts of venture capital invested in the industry. This was as a result of failed initial coin offerings, an inability to scale following periods of rapid growth and the falling price of Bitcoin. Still, VCs remained bullish on Bitcoin and blockchain technology in 2018, funneling a total of $2.2 billion in U.S.-based crypto projects — a nearly 4x increase year-over-year. Around the globe, investment hit a high of $4.6 billion — a more than 4x increase from last year, according to PitchBook.

“Notably, 2018 was the most active year for crypto in its brief ten-year history,” Loeffler wrote. “This was evidenced by rising investment in distributed ledger technology and digital assets, as well as by blockchain network metrics such as daily bitcoin transaction value and active addresses. Yet, these milestones tend to be overshadowed by the more narrow focus on bitcoin’s price, which has been seen by some, as a proxy for the potential of the technology.”

Today, the price of Bitcoin is hovering around $3,700 one year after a historic run valued the cryptocurrency at roughly $20,000. The crash caused many to dismiss Bitcoin and its underlying technology, while others remained committed to the tech and its potential for complete financial disruption. A project like Bakkt, created in-house at a respected financial institution with support from noteworthy businesses, is a logical bet for crypto and traditional private investors alike.

“The path to developing new markets is rarely linear: progress tends to modulate between innovation, dismissal, reinvention, and, finally, acceptance,” Loeffler added. “Each step, whether part of discovery or adversity, ultimately strengthens the product. Twenty years ago, it was controversial to suggest that commodities or bonds could trade electronically on a screen, and many steps were required for that evolution to play out.”

Comments

Post a Comment