Another day, another unicorn public offering.

Today it’s Acorns, a consumer fintech service that blends saving and investing into a freemium product. It’s a company that TechCrunch has covered extensively since its birth, including through the pandemic’s impact on its business, both good and bad.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Acorns fits inside the larger savings-and-investing boom seen over the last four or five quarters as consumers buffeted by the economic changes brought on by COVID-19 turned to stashing cash and boosting their equities investing cadence.

By now this is old news, but we haven’t had a clear picture of the economics of consumer fintech startups accelerated by the pandemic. Now that Acorns has decided to list via a SPAC — more on that in a moment — we do.

By now this is old news, but we haven’t had a clear picture of the economics of consumer fintech startups accelerated by the pandemic. Now that Acorns has decided to list via a SPAC — more on that in a moment — we do.

So this morning, we’re unpacking the Acorns deal and its investor deck, but we’re also trying to better understand why venture capitalists have poured so very much money into the space and the resulting economic picture that arises from the companies that they have funded. Acorns is our test subject, then.

We’ll start with a quick overview of its SPAC-led deal before getting into its results. Into the breach!

The Acorns SPAC deal

If your eyes are blurring as we review yet another SPAC transaction’s details, I get you. Let’s be brief. Here’s what you need to know:

- Acorns is merging with Pioneer Merger Corp., a public blank-check company

- Acorns CEO Noah Kerner and “Pioneer’s sponsor” are each giving 10% of their equity to select customers

- When combined, the entity will trade on the Nasdaq under the ticker symbol OAKS

You know, the thing you plant acorns to grow. Har har.

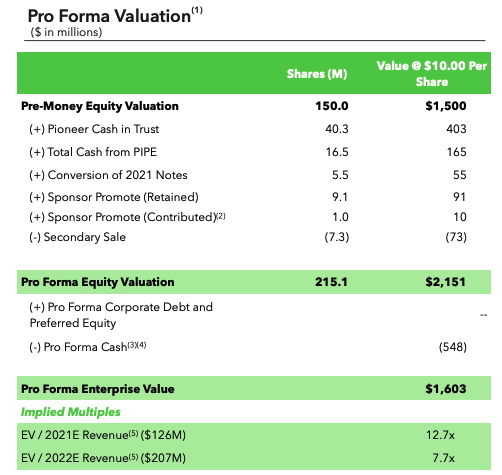

Here are the financial details of the transaction, via the company’s investor deck:

Image Credits: Acorns investor deck

Comments

Post a Comment