With the company growing in leaps and bounds, Zoom went shopping for a cloud infrastructure vendor to help it with its growing scale problem. In a surprising choice, the company went with Oracle Cloud Infrastructure.

Zoom has become the go-to video conferencing service as much of the world has shut down due to the pandemic, and life needs to go on somehow. It has gone on via video conferencing with Zoom growing from 200 million active users in February to 300 million in March. That kind of growth puts a wee bit of pressure on your infrastructure, and Zoom clearly needed to beef up its game.

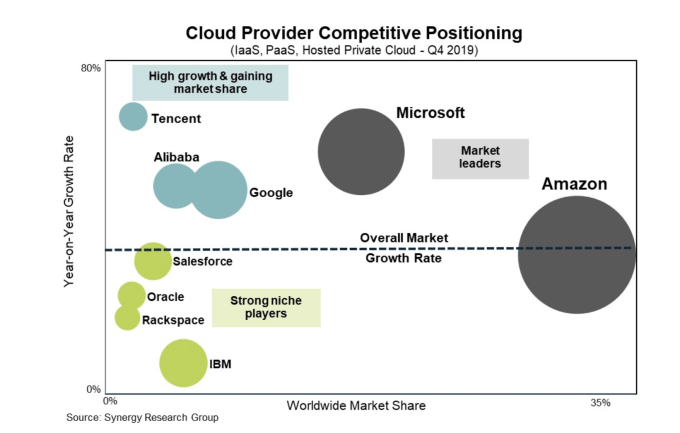

What’s surprising is that it chose Oracle, a company whose infrastructure market share registers as a strong niche player in Synergy Research’s latest survey in February. It is well behind market leaders including Amazon, Microsoft, Google, and even IBM (and that’s saying something).

Brent Leary, who is founder at CRM Essentials, says he sees this as a move to show that Zoom can move beyond the SMB market to power enterprise customers, no matter what they demand.

“I think Zoom went with Oracle because they are proven in the enterprise in terms of mission critical apps built on Oracle databases running on Oracle hardware in the cloud. Zoom needs to prove to enterprises that they are able to handle scale and data security needed to beyond what SMBs typically require,” Leary told TechCrunch.

In addition, Leary speculated that Oracle might have given Zoom a good deal to get a hot company into the fold and beat rivals like Amazon and Microsoft.

Others have speculated that it might have to do with keeping business away from a potential rival given that Amazon with Chime, Google with Hangouts and Microsoft with Teams all have competing products. However, none of them have become synonymous with online meetings as Zoom has during this crisis.

Zoom went public last year and has become the darling of the video conference market since in spite of a set of security issues that have developed as the company scaled, which they have been working to address.

The stock market is apparently not impressed with the choice. As we went to publish, the stock was down 3.38% or $5.56.

Comments

Post a Comment